The Tax Cuts and Jobs Act was signed late in 2017, and by now, most people know it will affect all taxpayers when they file their taxes this year. However, many people don’t know about a provision within the Act that may provide significant incentives for those looking to invest in economically-distressed communities.

The Opportunity Zone program is designed to encourage long-term investment in rural and low-income urban communities throughout the nation. It intends to accomplish this by offering tax incentives to encourage private investment in projects within these designated zones.

Two Investor Opportunities

There are two primary components of the Opportunity Zone program. First, investors can receive a temporary deferral of tax on any capital gains, so long as the gain is reinvested in a Qualified Opportunity Fund (QOF). A QOF is a partnership or corporation that invests in eligible property located in an Opportunity Zone. These capital gains can come from the sale of stock and bonds, real estate, or the sale of a business from an unrelated person. For those holding investments with significant unrealized capital gains, this may be a good time to give it some consideration.

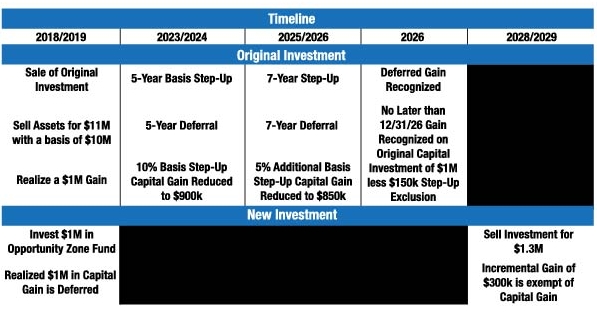

If an investor stays in the QOF for five years, 10 percent of the original gain is excluded from taxation. After seven years, an additional five percent of the gain is excluded. An investor must make the investment in the QOF by 2021 to take advantage of the 10-percent exclusion and by 2019 for the additional five-percent exclusion. If the investment is maintained in the QOF over seven years, the investor can exclude up to 15 percent of original gain from taxation. Investors can defer their original tax liability until December 31, 2026 at the latest, or until they sell their QOF investments, if earlier.

The second component of the program is likely the most compelling tax incentive. If the investment in the QOF is held for at least 10 years, the appreciation on the investment is permanently excluded from taxation.

Peoria’s Opportunity Zones

The Greater Peoria area has a number of designated zones, which are authorized by the Governor with some guidance from the federal government (primarily through low-income census tracts). Once the Opportunity Zone is established, it remains in place for 10 years. Peoria area zones include:

- Much of the downtown area, including the Warehouse District;

- A section north of Interstate 74, bounded by Knoxville Avenue and McClure Avenue;

- On the south side of the city;

- Pekin just east of the downtown and north of Court Street; and

- Much of Canton.

All of the Illinois zones can be located using a searchable map by visiting claconnect.com/opportunityzones.

Investment Timing Rules

There are some important rules regarding when an investment in a QOF must be made. Interested investors have 180 days to reinvest unrealized capital gains into an Opportunity Zone Fund. In addition, there are special rules regarding when the 180-day period commences for owners in pass-through entities such as partnerships, S corporations, estates and trusts. If owners are allocated capital gain, they can choose between commencing the 180-day period on either the last day of the entity’s taxable year or when the entity would begin its 180-day period. Below is an example of the flow of funds through the various events in an Opportunity Zone project:

Combined Incentives

The downtown Peoria area has also been added to the National Register of Historic Places, roughly bounded by N. William Kumpf Boulevard, Perry Avenue and Fulton, Fayette and Water streets. This designation gives developers the potential to combine the Opportunity Zone program with the Federal Historic Rehabilitation Tax Credit and other incentives based on the Illinois Rivers Edge Redevelopment Zone. iBi

Mark Colvin is a regional leader in CLA’s federal tax strategies practice. He can be reached at (309) 495-8754 or [email protected].

The information contained herein is general in nature and is not intended, and should not be construed, as legal, accounting, investment, or tax advice or opinion provided by CliftonLarsonAllen LLP (CliftonLarsonAllen) to the reader. For more information, visit CLAconnect.com.