How does the PATH Act affect your business or personal taxes?

As 2015 was coming to a close, those of us in the tax community found ourselves in an all-too-familiar situation: waiting with bated breath to discover the fate of more than 50 tax provisions that had expired at the end of 2014. Some were expecting a one-year extension of the rules; however, the Protecting Americans from Tax Hikes Act of 2015 (PATH Act) passed by the House and Senate in December provides for much more than just a one-year extension. This bill gives individuals and businesses some long-awaited assurances by making several key tax provisions permanent, as well as extending other important provisions over multiple years, many of which are retroactively applied to the beginning of 2015. The bill covers a plethora of topics, from how quickly businesses can write off their assets all the way to exclusions for qualified bicycle commuting reimbursements.

Clearly, there are too many provisions to cover in a single article, but some of the highlights of the bill most likely to have the biggest impact include:

Key Tax Provisions For Individuals

- State and Local Sales Tax Deduction. The PATH Act made permanent the election to claim state and local sales tax as an itemized deduction in lieu of state and local income taxes. This is especially valuable for taxpayers living in a state that does not assess income taxes or for retired individuals with very little state income tax liability.

- American Opportunity Credit. The American Opportunity Credit enhanced taxpayers’ allowable tax credit for qualified higher education expenses to a maximum of $2,500, subject to certain income limits. Phase-out of the credit begins at adjusted gross income (AGI) of $80,000 for single taxpayers and $160,000 for married-filing-jointly taxpayers. This credit, at the enhanced $2,500 level, was scheduled to expire after 2017; however, the PATH Act made this credit permanent.

- Child Tax Credit. The child tax credit allows for $1,000 credit for each qualifying child who lives with the taxpayer. For low-income taxpayers, this credit is refundable at 15 percent of earned income in excess of a threshold amount. This threshold amount of $3,000, unindexed for inflation, was scheduled to lapse after 2017. The PATH Act, however, makes the $3,000 threshold permanent.

- Charitable Distributions from IRAs. The PATH Act makes permanent the rule allowing individuals age 70½ and older to distribute up to $100,000 tax-free from an IRA directly to a qualified charity. This provision had expired at the end of 2014 prior to the passing of the PATH Act. This kind of IRA distribution counts toward a taxpayer’s Required Minimum Distribution obligation, which generally begins at age 70½. Amounts in excess of $100,000 must be recognized in the taxpayer’s income but can also be taken as an itemized charitable deduction subject to the existing AGI limitations for charitable contributions.

Key Tax Provisions For Businesses

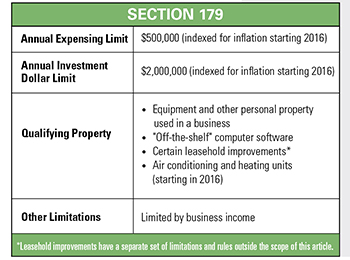

Code Section 179 Expensing. Code Section 179 allows businesses to immediately write off the full cost of qualified property given certain annual deduction and investment dollar limitations instead of having to depreciate this property over several years. Businesses have enjoyed a $500,000-per-year deduction limit, which began phasing out dollar-for-dollar at $2 million of annual investment in qualified property. At the end of 2014, these limits were scheduled to be reduced to a $25,000-per-year deduction limit with a $200,000 annual investment limit before phase-out. The PATH Act permanently sets the deduction limit at the higher limits discussed above. These limits will be indexed for inflation starting in 2016.

Code Section 179 Expensing. Code Section 179 allows businesses to immediately write off the full cost of qualified property given certain annual deduction and investment dollar limitations instead of having to depreciate this property over several years. Businesses have enjoyed a $500,000-per-year deduction limit, which began phasing out dollar-for-dollar at $2 million of annual investment in qualified property. At the end of 2014, these limits were scheduled to be reduced to a $25,000-per-year deduction limit with a $200,000 annual investment limit before phase-out. The PATH Act permanently sets the deduction limit at the higher limits discussed above. These limits will be indexed for inflation starting in 2016.

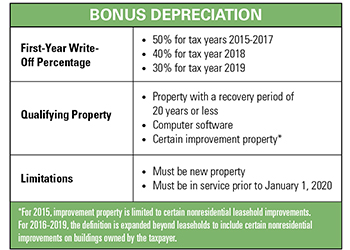

Also starting in 2016, the exclusion for air conditioning and heating units will be lifted, making them eligible for expensing under Section 179. These accelerated deductions can be a huge tax benefit to small businesses that regularly purchase equipment and other qualifying property on an annual basis. See the summary table for additional details. Bonus Depreciation. Another method of accelerating tax write-offs for qualifying property is bonus depreciation. Bonus depreciation allows for an immediate 50-percent write-off of the cost of qualified property in the year the property is first used in the business. The property must be new property to qualify (a used car, for example, would not qualify for bonus depreciation). At the end of 2014, this 50-percent write-off was scheduled to expire; however, the PATH Act extends bonus depreciation through 2019, phasing the allowable percentage down to 40 percent in 2018 and 30 percent in 2019.

Bonus Depreciation. Another method of accelerating tax write-offs for qualifying property is bonus depreciation. Bonus depreciation allows for an immediate 50-percent write-off of the cost of qualified property in the year the property is first used in the business. The property must be new property to qualify (a used car, for example, would not qualify for bonus depreciation). At the end of 2014, this 50-percent write-off was scheduled to expire; however, the PATH Act extends bonus depreciation through 2019, phasing the allowable percentage down to 40 percent in 2018 and 30 percent in 2019.

Additionally, certain interior improvements to nonresidential buildings will qualify for bonus depreciation starting in 2016. Currently, only new property with a 20-year life or less (most personal and farm property) qualifies for bonus depreciation. Nonresidential buildings, including improvements, generally have a 39-year life, so a 50-percent, first-year write-off would have tremendous impact in offsetting the long recovery period for buildings. See the summary table for additional details.- Research Tax Credit. While primarily used by large businesses, the research and development (R&D) tax credit is available to small businesses as well as for qualified research expenditures. The PATH Act made the R&D credit permanent. Due to the nature of research investments and the multiple years it may take to realize a benefit from such activities, many businesses that conduct qualifying research have been fighting for the permanency of this provision.

Miscellaneous Tax Measures

Outside the more than 50 tax provisions that were set to expire, the PATH Act provides for over 80 miscellaneous tax measures, including:

- Code Section 529 Plans. The PATH Act allows the purchase of a computer and computer-related expenses (such as printers, computer software or internet costs) with a distribution from a Code Section 529 plan. Commonly referred to as 529 plans, these tax-advantaged plans help set aside funds to pay for qualified higher education expenses of the plan’s beneficiary. If a distribution is taken from a 529 plan and is not used for a qualified expense, some of that distribution could be taxable to the owner of the plan. The inclusion of computers and related expenses as qualified expenses will only be upheld if the items are used primarily by the beneficiary during the years enrolled at an eligible education institution.

The PATH Act of 2015 is seen as a big step forward for tax reform in the United States. By making many of the provisions permanent, it eliminates uncertainty for business owners and allows for more well-rounded business decisions to be made. The Act also gives individuals a clearer picture to plan for their personal financial decisions. The items highlighted above hopefully shed some light on the key provisions that will be most beneficial for both business and personal tax strategies. iBi

Landon Roemersberger, CPA is a senior accountant at Heinold Banwart, Ltd. He can be reached at (309) 694-4251 or [email protected].