While unemployment rates are inching their way downward throughout the state and nation following the worst of economic times, the workforce was significantly impacted by the tough decisions employers had to make to survive. Whether it was layoffs, pay freezes or pay cuts, virtually every employer was faced with making tough business decisions to align costs with declining revenues. Now that there are signs of economic recovery, the new challenge for employers is how to hang on to their talent while still controlling costs.

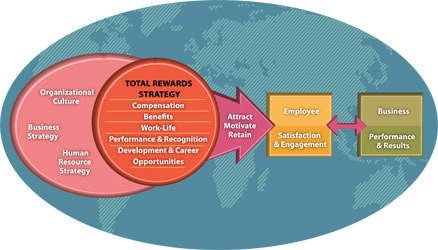

What are the drivers behind workforce issues that employers need to consider in attracting, retaining and motivating top talent in the recovering economy? There are five key areas to re-examine because of the cost-cutting measures taken during the economic downturn. They are compensation, benefits, work-life balance, performance and recognition, and development and career opportunities—otherwise known as total rewards, a model created by World at Work, a not-for-profit organization providing education and research on global human resources issues.

Compensation

According to a survey conducted in August 2010 by Hewitt and Associates, salary increases are expected to bounce back slightly in 2011. For salaried exempt workers, salaried nonexempt workers and executives, Hewitt’s survey shows base pay increases of 2.9 percent. Nonunion hourly and union employees can anticipate salary increases of 2.8 percent. The local AAIM EA survey conducted last fall showed increases in line with the national data.

The biggest trend is the shift from fixed, or base pay, to variable pay. Fixed pay is nondiscretionary compensation that does not vary according to performance or results achieved. It is usually determined by the organization’s pay philosophy and structure. Variable pay, also known as “pay at risk,” changes directly with the level of performance or results achieved. A one-time payment must be re-established and re-earned each performance period.

Like salary increases, spending on variable pay was also lower than expected in 2010 due in large part to lackluster company performance. In 2010, spending on variable pay as a percentage of payrolls for salaried exempt workers was 11.3 percent, down from a record high of 12 percent in 2009. Spending in 2011 is expected to creep upward to 11.8 percent, which would be the second highest increase since Hewitt began tracking the data in 1976.

TIP: If your organization either froze wages or implemented pay cuts during the past couple of years, it is time to re-examine pay structures and wages by comparing with the market through credible compensation surveys.

Benefits

Benefits

If your organization made changes to benefits plans to shift more costs to employees in the past couple years, you are not alone. Results of the Mercer Health Benefit survey conducted last November indicate that employers expect high cost increases again in 2011. They predicted that cost would rise by about 10 percent if they made no health program changes, with roughly two percentage points of this increase coming solely from changes mandated by the new healthcare reform legislation. However, employers expect to hold their actual cost increases to 6.4 percent by making changes to plan design or changing plan vendors.

Employers will soon be more limited in how they can shift costs to employees. Starting in 2014, the healthcare reform bill sets minimum standards for “plan value” (the percentage of healthcare expenses paid by the plan) and “affordability” (the employee’s share of the premium relative to household income). These changes are bringing greater focus on improving workforce health as a way to control the cost of health benefits. Over the past decade, employers have been adding a wide range of programs under the employee health management or “wellness” umbrella, from health risk assessments to disease management programs to behavior modification programs.

TIP: To further control healthcare costs consider using an insurance broker. A broker might be able to negotiate lower premium increases for you than if you deal directly with the insurance carriers. Review your health insurance package annually. Assess what you are offering to employees and look for opportunities for cost savings. Communicate your benefits costs to employees. Pay as much of the benefits as you can and make sure that you tell them about it in a way that makes sense to them. For example, instead of tallying up your total premium expenses, break the costs down so that employees can see how much the company is spending on them in addition to their compensation.

Work-Life Balance

Many employers see this area as a little soft and fuzzy for the workplace. But in reality, work-life initiatives can be a strong driver in creating a rich culture within your organization. This was probably one of the hardest hit areas of the workplace during the recent downturn. Work-life balance involves a specific set of organizational practices, policies, programs and a philosophy that actively supports efforts to help employees achieve success at both work and home.

There are seven major categories of organizational support for work-life effectiveness in the workplace, encompassing compensation, benefits and other HR programs. In combination, they address the key intersections of the worker, his or her family, the community and the workplace. These seven major categories are:

- Workplace flexibility

- Paid and unpaid time off

- Health and well-being

- Caring for dependents

- Financial support

- Community involvement

- Management involvement/culture change interventions.

TIP: If you asked members of your team if they felt overworked, what would be their response? If they say “yes,” consider the following outcomes, based on the “Overwork in America, When the Way We Work Becomes Too Much” study by the Families and Work Institute. They are more likely to make mistakes and be angry with the employer for expecting them to do too much, and they are more likely to resent coworkers who do not work as hard as they do. On a personal level, they are more likely to have higher stress levels, suffer from depression, be less healthy and neglect caring for themselves. The study also indicates that an effective workplace (what you should aspire to) is one in which employees have opportunities for learning, are supported by their supervisor, have the flexibility to manage their personal and family lives, and have input into decision-making.

Performance and Recognition

This is a key component of organizational success. Performance is the alignment of organizational, team and individual efforts toward the achievement of business goals and organizational success. Do you have a performance planning process whereby expectations are established, linking individual goals with team and organizational goals? In the face of challenging business conditions, this can be an area that is neglected.

But remember the saying, “Plan your work and work your plan.” In performance planning, care should be taken to ensure that goals at all levels are aligned and there is a clear line of sight from performance expectations of individual employees all the way up to organizational objectives and strategies set at the highest levels of the organization.

TIP: Performance and recognition are closely linked to employee engagement. Engaged employees are more productive, profitable and customer-focused, safer, and more likely to withstand temptations to leave your organization. Gallup has 30 years of data supporting the impact of engagement to the bottom line.

Remember the book, First Break All the Rules, and the 12 elements of great management. How would your workforce answer these questions?

- I know what is expected of me at work.

- I have the materials and equipment I need to do my work right.

- At work, I have the opportunity to do what I do best every day.

- In the last seven days, I have received recognition or praise for doing good work.

- My supervisor or someone at work seems to care about me as a person.

- There is someone at work who encourages my development.

- At work, my opinion seems to count.

- The mission or purpose of my organization makes me feel my job is important.

- My associate or fellow employees are committed to doing quality work.

- I have a best friend at work.

- In the last six months, someone at work has talked to me about my progress.

- This last year, I have had opportunities at work to learn and grow.

Development and Career Opportunities

This is a set of learning experiences designed to enhance employees’ applied skills and competencies. Development engages employees to perform better and leaders to advance their organizations’ people strategies. This is typically one of the first expenses to go when it comes to belt tightening. On the other hand, career opportunities refers to the plan for an employee to advance his or her own career goals and may include advancement into a more responsible position in an organization. Ideally, the organization supports career opportunities internally so that talented employees are deployed in positions that enable them to deliver their greatest value to their organization.

TIP: If your organization is at a point to re-establish training and development initiatives, the return on investment will be more evident when the specific skills and competency development are tied back to your business strategy. By identifying development opportunities during the performance review process, in conjunction with conducting a training needs assessment, your organization will be on the way to having an increasingly motivated and productive workplace.

The workforce is the single greatest asset of an organization. It is what sets an organization apart from the competition. Now that you are on the road to recovery, how will you move ahead, working “on” your business as opposed to “in” your business to grow the bottom line? iBi