In difficult economic times, companies: (1) develop and market innovative products, and (2) decrease product costs. In a survey developed by CGN & Associates and a team at Bradley University’s Foster College of Business, it was found that most companies strive to increase sales effectively and decrease costs profitably. In the survey, 53 percent stated that “the…impact [on their business] of the current economic slowdown was ‘high’ or ‘very high.’” The following article describes Peoria, Midwest and global examples of why companies achieve success as economic growth slows.

Develop and Market Innovative Products

Companies are relying on product development and marketing based on customer needs. All of the following companies have achieved success in a challenging economy.

First, as the U.S. economy falters, it is increasingly driven by companies which develop innovative products. On May 30, 2008, the 105-year-old investment bank, JP Morgan, was replaced on the S&P 500 by Intuitive Surgical, a company founded in 1995 which created minimally-invasive robotic technologies. Founded in 2003, a Peoria-based high-tech startup, Firefly Energy Inc., created a truck battery which lasts twice as long as current batteries developed over the last century. It is not the age of the company, it is the idea.

Second, the ever-creative Apple develops innovative products which stand out in a crowded marketplace. In the U.S., where nearly everyone has a mobile phone, Apple’s iPhone was able to sell five million units and gain 19 percent market share in the first year of introduction. The new iPhone 3G 2008 is marketed as “twice as fast, half the price.” According to a July 2008 Computerworld article, less than two weeks after launch, only nine percent of Apple’s stores had iPhones available, and none of the AT&T partner stores had any iPhones. East Peoria’s iRepair Squad refurbishes iPods and iPhones, capitalizing on the need to service innovative products. How many companies will reveal a product which is twice as good at half the price? Very few, but products which stand out will sell out, even in a faltering economy.

Third, Toyota developed the hybrid Prius to target its customers’ pain point of high gas prices. Duane Angevine, general manager of Peoria Toyota, in a recent article in the Peoria Journal Star, said there is a three-month wait for the 45-mpg Prius. As gas reached $4 per gallon, the Toyota Prius hit one million in sales in May 2008. Toyota shifted production at its Blue Springs, Mississippi factory away from large vehicles to meet the increased demand for the Prius. If businesses lead to the customers’ pain points, profits will follow.

Third, Toyota developed the hybrid Prius to target its customers’ pain point of high gas prices. Duane Angevine, general manager of Peoria Toyota, in a recent article in the Peoria Journal Star, said there is a three-month wait for the 45-mpg Prius. As gas reached $4 per gallon, the Toyota Prius hit one million in sales in May 2008. Toyota shifted production at its Blue Springs, Mississippi factory away from large vehicles to meet the increased demand for the Prius. If businesses lead to the customers’ pain points, profits will follow.

Fourth, even when times were difficult, Merck invested heavily in research and development to discover new medicines. In Fortune magazine, strategist Ram Charan explains, “Merck’s CEO, Ray Gilmartin, increased investment in R&D from 12 percent of revenue in 1999 to 20 percent of revenue in 2004.” Today, those FDA-approved drugs account for approximately $7 billion in revenues. After this heavy R&D investment, Merck’s stock price increased nearly 75 percent from 2006 to 2008. A challenging economy means companies should invest in R&D, not cut it.

Fifth, a Midwestern heavy-equipment manufacturer needed to develop new products faster. If this manufacturer does not meet deadlines associated with government-regulated emissions requirements, the company will go out of business. CGN’s Innovative Product Development eXecution (IPDx) helped the company reduce engineers’ testing time by 10 to 15 percent, saved approximately $625,000 and improved quality by reducing defects. The company that delivers products faster, cheaper and with fewer defects will increase sales and improve the brand equity.

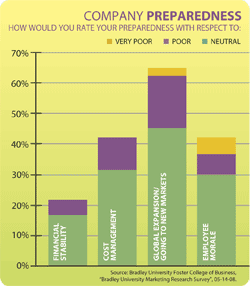

Sixth, if you have great products, sell them to new markets which are experiencing economic growth. In the Bradley University survey, nearly 65 percent of companies rated their “global expansion/going to new markets” as “poor” or “neutral” when confronting a possible recession. Task Force Tips, a 175-employee firm in Valparaiso, Indiana, makes $1,000 variable-spray nozzles for firefighting equipment. For one order in 2008, Sinopec, the Chinese oil company, ordered the equivalent of 10 percent of Task Force Tips’ total 2007 revenues, according to Forbes magazine. Why order a product cheaply copied by Chinese, Indian and British firms from a small American company in Indiana? Quality. The same article quotes CEO McMillan saying, “People’s lives depend on it.” If a company’s current markets are not growing, find ones that are.

Decrease Product Costs

Companies must dramatically reduce their product costs, especially if they are unable to increase product development and marketing.

First, companies should reduce costs in areas the customer does not see. The company should identify areas that do not compromise performance and quality. CGN has developed a material cost management process leveraging Akoya’s competitive banding analysis technique. As a result, the client saved, on average, $45 million per year, or a total of $227 million over a five-year period from 2003 to 2007. The team identified the top ten ideas for cost savings, reached consensus between engineering and purchasing, and consistently generated over $1 million in savings per four-hour workshop. Companies should analyze their purchasing costs to find areas where the customer is not impacted.

Second, companies are fighting drastically rising fuel costs. In order to show a Midwest company the total impact of $4-per-gallon gas, CGN developed an advanced financial simulation tracing fuel throughout the system. Using these advanced analytics, companies can shift investment from one resource to another.

Third, companies need sophisticated ways to determine where to reduce capacity or production. According to the survey, companies stated that “during a downturn, approximately 28 percent would reduce capacity or production. While this may be a good way to deal with decreasing sales, companies should properly identify where production cuts can occur and where production should be increased. Companies do not want to cut production just prior to the economic upswing.

Fourth, companies will be stronger if they work closely with employees. In the Bradley University survey, 55 percent of companies rated their employee morale as “good” when confronting a possible recession. In good and bad times, communication should include “intranet letters, division meetings, town hall gatherings, discussion of business plans and asking for advice,” notes strategist Ram Charan. “During a downturn, approximately 64 percent of companies would be unlikely to ‘decrease new recruitments’ and 76 percent would be unlikely to ‘reduce employee benefits/perks.” Companies maintain good morale by keeping necessary benefits or perks. When good economic times return, a highly motivated, loyal workforce will be critical to the company’s success.

Conclusion

During difficult economic times, successful companies are focusing on global customer needs, delivering innovative products, analytically decreasing product costs and cost-cutting in areas that are not critical to the customer and/or employee satisfaction. These difficult economic times, surprisingly, require simple business solutions. iBi

The “Bradley University Marketing Research Survey” referenced in this article was developed by CGN & Associates in conjunction with a team at Bradley University’s Foster College of Business. Team members included Andrew Albritton, Susan Barenbrugge, Jordan Hill, Dana Rae Nelson and Thomas Rocco.