While college planning can be stressful, there are tools available to help you plan for your child’s brighter future.

College costs are growing at a rate faster than inflation, and student loan debt is growing. A proactive plan helps maximize every dollar available for college. It’s important to have an understanding of 529 plan rules, the impact of financial resources on FAFSA, and how to fund it.

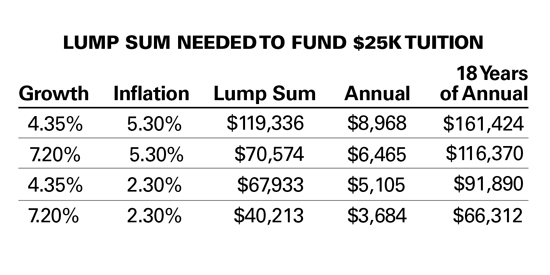

Parents often worry about saving enough for their child’s college education. Sometimes they even worry about saving too much and what to do with the extra funds. The following chart shows the different variables that are out of your control—and how they will affect the end results. The chart shows the amounts needed to fund four years of college in the future, estimated at $25,000 per year, using the assumptions of two different inflation rates and two different portfolio growth rates.

If inflation outpaces the growth of the portfolio, you will need to save more to have enough funds in 18 years. In contrast, if the growth rate exceeds inflation, you can get by with saving less. The cost of tuition in 18 years, however, is a big unknown, because there are no guarantees on college tuition, just as there are no guarantees with regard to the market’s growth rate.

One strategy to avoid overfunding a 529 account is to fund it with up to 75 percent of the expected future cost of the college. If it’s a lump sum, you may want to start with funding just 50 percent of the expected future cost upfront. Other factors to consider in determining how much to save in 529 accounts include multiple children, cost of tuition, the potential for graduate school, and other saving and spending goals you may have.

What is a 529 plan?

There are two 529 plans in Illinois. One is called Bright Directions, and the other is Bright Start. The average fees for Bright Directions range from 0.74 to 0.85 percent, plus an initial sales charge of 3.5 percent. In contrast, the age-based index portfolios offered by the Illinois Bright Start plan use Vanguard funds with an average fund cost of 0.13 percent. The Bright Start program can be attractive because it offers passively managed portfolios for a low cost.

Furthermore, Illinois allows a tax deduction of $10,000 per year for a single filer, or $20,000 per year for those married filing jointly. That is a savings of $49.50 per $1,000—or $495 per taxpayer if $10,000 is contributed.

Another strategy available to Illinois taxpayers is to use a 529 plan as a pass-through when funding college from cash flow to receive state tax deductions. This means you can deposit the amount to pay tuition into the 529 plan, and then withdraw it the next day to pay tuition, providing you with a state tax deduction.

My child will not attend college… now what?

You can change the beneficiary of a 529 plan to any of the following:

- Children (including foster children) and their descendants;

- Siblings or step-siblings;

- Parents (including step-parents);

- Nieces and nephews;

- Aunts and uncles;

- A son-in-law, daughter-in-law, father-in-law, mother-in-law, brother-in-law or sister-in-law;

- A spouse, or the spouse of any of the foregoing individuals; and

- First cousins.

If that doesn’t sound desirable, you have the option of withdrawing the funds and paying a 10-percent penalty along with tax on the earnings.

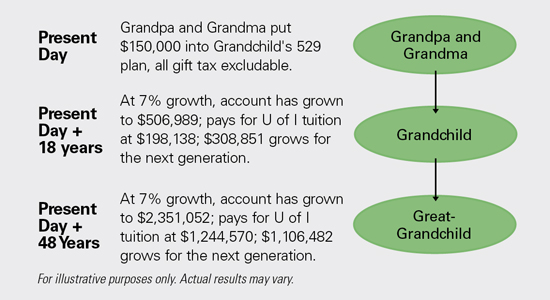

As a final thought, consider the impact of allowing a 529 plan to grow for the next generation—or even the one after that. Here is an example of what to do with unused 529 plans:

A 529 plan may be a great way to set up a multi-generational college funding program—and no trust or attorney is needed to set it up. iBi

Daryl Dagit is the Market Manager and Financial Advisor in the Peoria office of Savant Capital Management. He can be reached at (309) 693-0300.